Let’s stipulate that business travel is essential for many companies, whether it be for meetings with clients, conferences, or other corporate needs. But it’s also a major expense. Managing business travel spend efficiently is key to controlling costs. Rather than relying on conventional payment methods like cash, checks, or personal credit cards, implementing a virtual card program specifically for travel bookings and expenses can provide significant advantages.

What are virtual cards and how do they work?

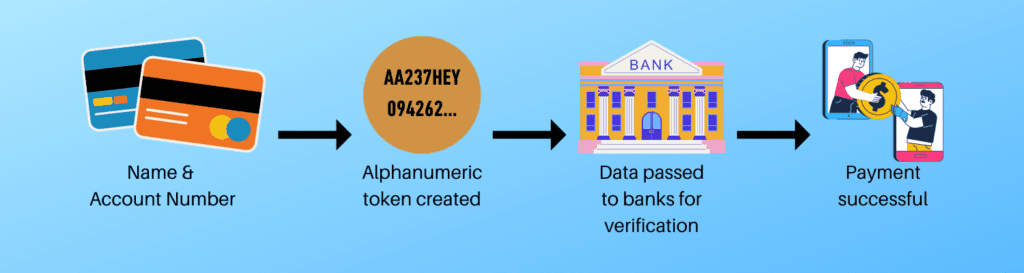

Virtual cards are digital, temporary credit card numbers that used in place of physical cards for business expenses and travel bookings. They are generated for specific transactions with preset spending limits and expiration dates. Virtual Cards fall under a central corporate account but provide the functionality of an individual credit card number. When making a purchase with a single-use number, the digital card works the same as a physical card and the payment management system captures the transaction data. After use, the card information disappears until the next transaction requests a new number.

Virtual payments are transacted the same way as physical payments but more securely.

Key benefits of using virtual cards for travel:

Increased Visibility and Control Over Spend

With virtual card numbers tied directly to each employee, businesses gain clear visibility into who is spending what. An online management system tracks all transactions, providing transparency in every booking and purchase. Travel Managers can set limits on virtual cards to match the exact cost of flights, hotels, rental cars, etc., preventing overspending. They can also turn off the cards when not in use, reducing the risk of fraud.

Streamlined Expense Reporting

Expenses made with virtual cards get automatically documented in the card system and can integrate with expense reporting tools. There’s no need for employees to collect receipts or reconcile expenses. This saves a tremendous amount of time and effort compared to traditional expense reporting. Employees don’t have to submit anything for reimbursement either.

Improved Cash Flow

When companies use one of multiple virtual payment programs available, employees don’t have to spend their own cash for business trips and wait weeks or months for reimbursement. Businesses also don’t have to front the money for every trip and can efficiently pay for contractor or non-employee travel. They can negotiate better terms with virtual cards as well, allowing 30-45 days to pay instead of requiring immediate payment. This improves cash flow and financial management across the company.

Enhanced Rewards

Many virtual card solutions allow businesses to earn rewards on their travel spend such as points, miles, or cash back. The business may use rewards for free travel or cash back. It’s an added perk on top of the other benefits virtual cards provide.

Tighter Vendor Relationships

Virtual card numbers can be assigned for use with only specific vendors such as airlines, hotels, or rental car agencies. Virtual payment systems can generate robust transactional data for analysis, which allows businesses to build stronger relationships with preferred vendors. Having a dedicated virtual card for each vendor also facilitates accounting.

A new survey of 541 travel decision makers found that 90% of respondents said they plan to offer a travel and entertainment card program to improve processes. And just over 90% are interested in the next five years in providing virtual corporate cards to employees to pay for trip expenses. Nine in 10 respondents believed virtual cards would either be commonplace for most companies (48%) or what distinguishes innovative companies (42%) within the next five years.

For any business that requires frequent employee travel, implementing virtual payment systems can significantly optimize the process. The increased oversight, efficiency, flexible timing of payments, built-in rewards, and improved vendor relationships allow companies to better control one of their highest overhead costs. The advantages of virtual cards in managing travel spend are worth considering. For help implementing a program for your company, contact your Covington Account Manager.

Leave a Reply