As the calendar year closes, many business travelers and their organizations are sharpening their pencils to draw up budgets for 2018 expenses. Travel is a significant line item for small businesses as well as large corporations. While it’s rare to perfectly calculate travel expenditures in advance, an understanding of the global economic factors at play and cost expectations for the next year help project a realistic travel budget. To assist, here is an overview of the 2018 business travel forecast for the three major categories of air, hotel, and ground transportation, as predicted by Global Business Travel Association (GBTA).

As the calendar year closes, many business travelers and their organizations are sharpening their pencils to draw up budgets for 2018 expenses. Travel is a significant line item for small businesses as well as large corporations. While it’s rare to perfectly calculate travel expenditures in advance, an understanding of the global economic factors at play and cost expectations for the next year help project a realistic travel budget. To assist, here is an overview of the 2018 business travel forecast for the three major categories of air, hotel, and ground transportation, as predicted by Global Business Travel Association (GBTA).

A Strong Economy Means Higher Travel Costs

The global economy is projected to grow by 3.6 percent in 2018 (IMF) after a 3.5 percent increase this year. With growth, markets feel confident and spend more freely. That higher demand gives travel suppliers – airlines, hotels, and ground transportation – the business they desire without the need to offer price incentives. Because of this, we can expect a rise in travel costs in 2018.

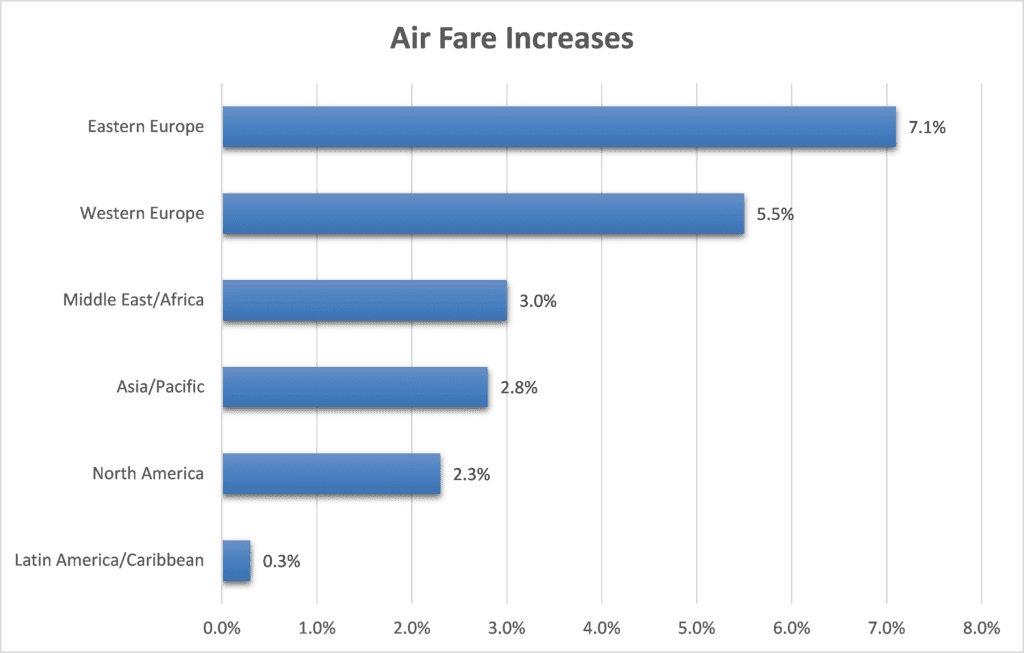

Air Travel Forecast

With crude oil prices on the rise and the increase in travel demand due to economic growth, global airfares will increase an average of 3.5 percent with the sharpest increases in Eastern Europe. A 6 percent growth in passenger capacity and the entrance of basic economy fares will mitigate the increase in North America. Latin America increases will be minimal, well below the 3 percent inflation rate.

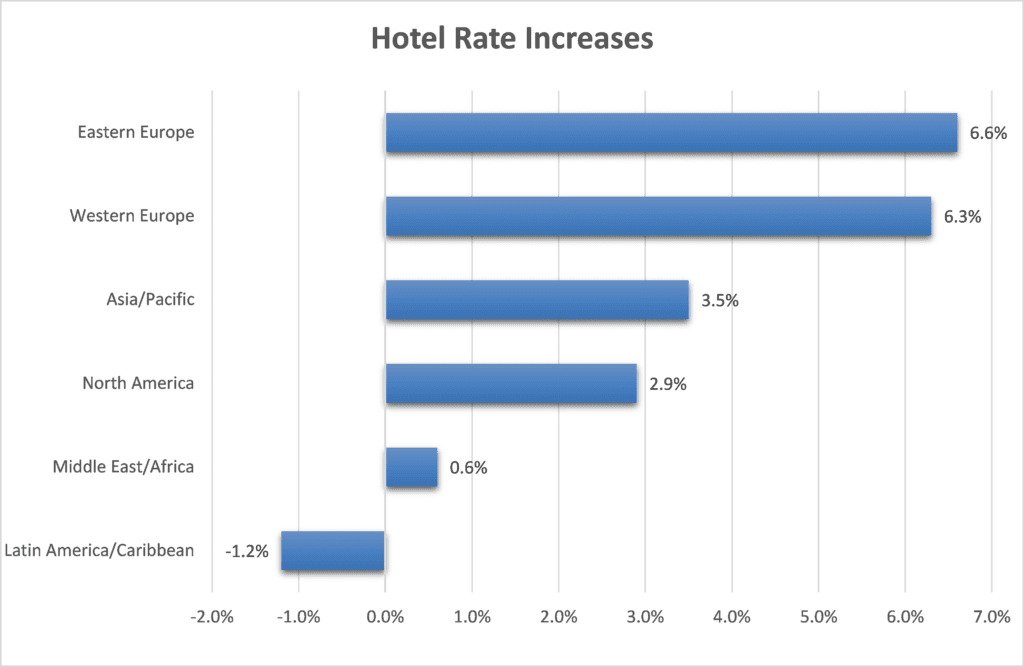

Hotel Rate Forecast

Globally, hotel prices are projected to increase 3.7 percent, although, like air forecasts, there will be differences regionally. Again, Europe prices will bear the strongest increases, with Norway expecting a whopping 14 percent rise. North America hovers near the inflation rate, and Latin America prices are actually projected to fall.

BCD reports that hotel chains are moving corporate pricing from fixed negotiated rates toward dynamic pricing which means a fixed discount on the best available rate. This is often more expensive than preset negotiated rates; however, hotels have also been retracting last-room availability from corporate rates, so business travelers are often unable to take advantage of negotiated rates anyway.

Ground Transportation Forecast

Ground Transportation Forecast

Ground transportation pricing is projected to only increase 0.6 percent globally over the next year, but 5.5 percent in the next five years. Pricing in Europe will remain flat because rail continues to be a practical alternative to air travel, and car rentals expect increased supply from the Enterprise expansion. Conversely, in North America, limited rail options and increased corporate travel demand will push car rental prices up by 1 percent (4.6 percent in Canada).

Suppliers are increasingly offering “green” rental cars due to emissions regulations and rising oil prices. Sharing economy players such as Uber and Lyft will continue strong growth, although they are pressured by expensive regulation and government bans. New technologies such as self-driven vehicles, high-speed rail, and green fuel alternatives will continue to influence ground transportation pricing.

For questions or further discussion about these projections and industry trends, contact Covington’s Business Travel Services team.

About the 2018 Forecast

Forecast projections provided by CWT Solutions Group. Data analysis provided by Rockport Analytics. The report, 2018 Global Travel Forecast, is available exclusively to GBTA members by clicking here and non-members may purchase the report through the GBTA Foundation by emailing pyachnes@gbtafoundation.org.

Leave a Reply