Without a doubt, you’ve heard of the ride sharing Phenom called Uber and may have used it yourself. The 2010 startup company has taken ride-sharing – a.k.a. Transportation Network Companies (TNC) – to a global level, growing at an unprecedented rate and is now valued at more than $41 billion.

Without a doubt, you’ve heard of the ride sharing Phenom called Uber and may have used it yourself. The 2010 startup company has taken ride-sharing – a.k.a. Transportation Network Companies (TNC) – to a global level, growing at an unprecedented rate and is now valued at more than $41 billion.

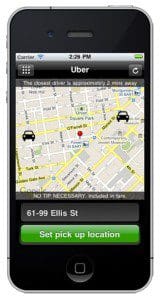

On the off-chance that you aren’t familiar with Uber, here’s how it works: You call a car with a tap on your smartphone and you can watch its approach on the map. Your car arrives in just minutes and the driver greets you by name. At your destination, payment is made by credit card within the app, then you hop out and go on your way – efficient and cashless.

What began as a lifestyle company has morphed into a major player in ground transportation options – one that has gotten the attention of business travelers. But Uber usage challenges the business travel status quo, upsetting the apple cart for some industry players and many companies’ managed travel programs.

Uber Airport Access

Airports across the U.S. are grappling with the legality of ride-share pickups. Orlando International Airport has a pending lawsuit to block Uber pickups and New York’s Taxi Commission is attempting to prevent Uber from parking at LaGuardia’s pick up area. At issue is the question of commercial insurance licensing, lost airport concession fees, and other regulatory opposition. Traditional taxis are suffering a fairly significant loss of business and many are actively lobbying against Uber’s airport access.

Other airports in cities such as San Francisco, Uber’s hometown, and Phoenix have reached permit and registration agreements with Uber. Troy Bell, Director of Marketing & Air Service Development for Richmond International Airport (RIC) says that they have attempted to stay “purposefully neutral” in the local debate. “TNC’s have a niche.”

Managed Travel Programs

Arguably, the most important functions addressed by a managed travel program are Duty of Care and risk mitigation. While several high-profile Uber assaults have been published in the media, and some feel traveler safety could be compromised, the question remains whether Uber is any less safe than traditional taxis.

Like taxi drivers, Uber drivers undergo a criminal background check. When a Uber car is called, the traveler gets driver identity information in advance through the app which they can visually match upon pickup. What’s more, Uber drivers and riders get rated by each other and it’s rumored that any driver with a score falling below 4.7 out of 5.0 is “deactivated.” Uber cars are GPS monitored, so there is a record of where the car went and for how long, which is not only a security plus, but helpful to travel managers who need to keep track of their travelers. In addition, the in-app payment is cashless, reducing risk of theft. These functions can’t guarantee safety, but much more identifying data is generated and tracked with Uber than a taxi.

Another major focus of a managed travel program is controlling travel spend. This usually means building preferred vendor relationships that offer volume advantages or necessary geographic coverage. In most cases, Uber is not able to fully replace an existing car service relationship, but at times makes sense for individual traveler use. Increasingly, businesses are accepting Uber into their managed travel program, although that means expense reporting has to be facilitated.

Major expense reporting software, Concur, has integrated with Uber so e-receipts are automatically and electronically delivered to the traveler’s expense report, eliminating the need to reconcile paper taxi receipts with corporate card charges. Recently, Uber also added the ability for travel managers to set time and location parameters for which rides are approved.

While travelers praise the efficiency of Uber and say they like not having to carry cash, ride-sharing services are far from being commonly accepted in corporate travel policies … yet. A survey of the Association of Corporate Travel Executives (ACTE) earlier this year found that only 20 percent of respondents currently allow their business travelers to use ride-sharing apps like Uber, but another 20 percent say they are considering it for corporate travel.*

Do you use Uber for business travel? Share your thoughts on ride-sharing in the comments below.

* Source: The Post and Courier

Leave a Reply